We expect

Zoetis Inc.

ZTS

to surpass expectations when it reports fourth-quarter 2021 results on Feb 15, before market opens.

Zoetis’ earnings surprise history has been excellent so far, having surpassed expectations in each of the trailing four quarters, with an average of 12.7%. In the last reported quarter, Zoetis delivered an earnings surprise of 13.6%.

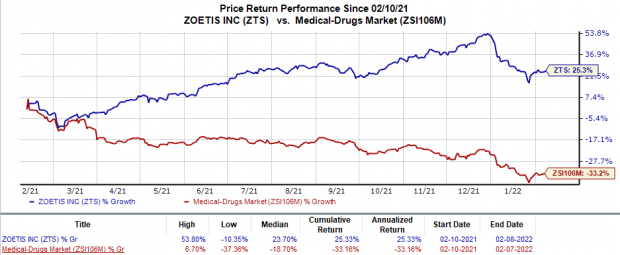

In the trailing 12 months, shares of Zoetis have increased 25.3% against the

industry

’s 33.2% decline.

Image Source: Zacks Investment Research

Let’s see how things have shaped up for this announcement.

Factors to Consider

Zoetis derives the majority of revenues from a diversified product portfolio of medicines and vaccines used to treat and protect livestock and companion animals. The company reports business results under two geographical operating segments — United States and International.

Revenues in the last reported quarter increased year over year to $1.065 billion in the United States, a trend that most likely continued in the fourth quarter as well. The Zacks Consensus Estimate for revenues in the United States is pegged at $1.020 billion.

Zoetis’ international revenues in the last reported quarter increased year over year to $904 million. This trend is also expected to have continued in the to-be-reported quarter. The Zacks Consensus Estimate for international revenues stands at $884 million.

Strong sales of the dermatology portfolio — owing to increased sales of Apoquel and Cytopoint brands — strengthened the U.S. segment in the last reported quarter, a trend that most likely continued in the fourth quarter as well. Zoetis’ companion animal business has also been performing well, primarily owing to higher sales of Simparica Trio, a triple combination parasiticide for dogs.

In the last reported quarter, sales of livestock products declined year over year, a trend that most likely continued in the fourth quarter as well. Sales of poultry products also declined in the last reported quarter due to the expanded use of lower-cost alternatives for premium products, a trend that is expected to have continued in the to-be-reported quarter. Sales of cattle products also decreased year over year due to increased generic competition, a trend that most likely continued in the fourth quarter as well.

In the last reported quarter, sales of swine products declined year over year due to pricing pressure on anti-infectives and vaccines, a trend that is expected to have continued in the to-be-reported quarter.

For the International segment, sales of companion animal products increased in the last reported quarter. The trend is expected to have continued in the fourth quarter as well.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Zoetis this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here as you will see below. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP:

Zoetis has an Earnings ESP of 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate stand at 96 cents.

Zacks Rank:

Zoetis currently carries a Zacks Rank #3.

Stocks to Consider

Here are a few stocks you may want to consider as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Cara Therapeutics

CARA

has an Earnings ESP of +5.24% and a Zacks Rank #1. You can

see the complete list of today’s Zacks #1 Rank stocks here

.

Cara Therapeutics’ loss per share estimates for 2022 have narrowed from $1.49 to $1.47 in the past 30 days. Cara Therapeutics topped earnings estimates in three of the last four quarters, delivering a surprise of 126.9%, on average.

Evelo Biosciences

EVLO

has an Earnings ESP of +12.79% and a Zacks Rank #2.

Evelo Biosciences’ loss per share estimates for 2022 have narrowed from $2.19 to $2.12 in the past 30 days. Evelo Biosciences missed earnings estimates in each of the last four quarters, delivering a negative surprise of 13.2%, on average.

Vir Biotechnology

VIR

has an Earnings ESP of +32.05% and a Zacks Rank #1.

In the past 30 days, earnings per share estimates of Vir Biotechnology for 2022 have increased from $4.77 to $6.53. In fact, Vir Biotechnology topped earnings estimates in two of the last four quarters and missed the mark on the other two occasions, delivering a surprise of 13%, on average.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report