Westport Fuel Systems Inc.

WPRT

recently announced that it has been awarded a program to develop and supply liquefied petroleum gas (LPG) systems to a global original equipment manufacturer (OEM) to accommodate a number of its Euro 7 vehicle platform. The deal is anticipated to generate €40 million in annual revenues, and production is slated to begin in first-quarter 2025.

Driving alternative fuel technology adoption from light-duty to heavy-duty applications is a keystone of Westport’s OEM technology supply strategy. Earlier this year, Westport had won a €38 million contract to support the same OEM with LPG system solutions for its Euro 6 vehicle applications. Per the recent program, the company will supply the entire LPG system from the fuel tank to the fuel injectors for the OEM’s Euro 7 applications.

Westport is enthusiastic about the new contract. By supporting both Euro 6 and Euro 7 application requirements, it will ensure cleaner vehicles and improved air quality and make European communities more sustainable. WPRT’s market-leading solutions provide affordable, clean transportation that optimizes overall vehicle performance and efficiency.

LPG and bio-LPG are clean-burning alternative fuels used to power light, medium and heavy-duty vehicles. LPG-fueled vehicles are economical and low on emissions compared to vehicles using traditional fuels. Moreover, LPG-fueled vehicles are permitted to drive in emissions-restricted traffic zones in Europe. Therefore, LPG is fast gathering steam in markets like Europe, where refueling infrastructure is well established.

Seeking alternative fuel technology, ranging from light-duty to heavy-duty applications, has been a focus area of Westport’s OEM technology supply strategy.

Its portfolio of eco-friendly product mix is set to boost prospects amid climate change concerns. Westport HPDI 2.0 offers an environment-friendly robust performance for heavy-duty trucks, thereby positioning the company favorably as the transition to green transportation solutions intensifies. The company is taking great strides to develop the LPG ecosystem. The contract signed with NAFTAL in November 2021 to supply 60,000 liquefied petroleum gas systems through the 18 months from the starting period augurs well. Moreover, its acquisition of Stako, a leading manufacturer of LPG fuel storage systems in 2021 has enhanced Westport’s ability to supply completely integrated fuel systems and its vision to transition to cleaner fuels, especially in emerging markets and has added to its top line. Collaborations with TUPY and AVL to develop highly efficient hydrogen internal combustion engines for heavy goods transportation also bode well.

WPRT’s independent aftermarket business is gaining from the continued price advantage of LPG in many of its markets, and the trend is likely to continue in the near-term, bolstering prospects. LPG, with a significant price advantage over petrol, contributes to Westport’s robust performance.

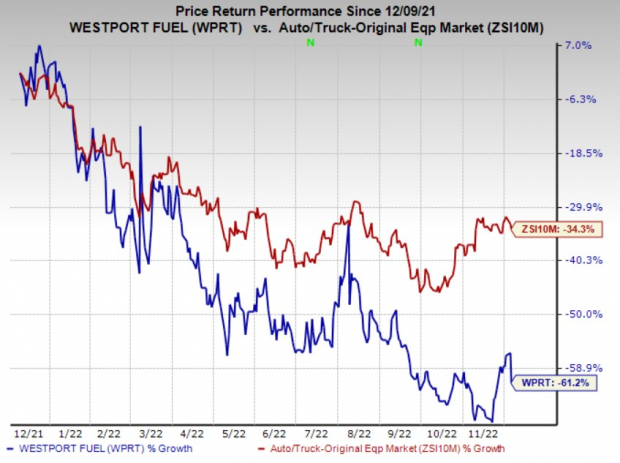

Shares of WPRT have lost 61.2% over a year compared with the

industry

’s 34.3% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

WPRT currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked players in the auto space –

CarParts.com

PRTS

, sporting a Zacks Rank #1 (Strong Buy), and

Allison Transmission Holdings

ALSN

and

Genuine Parts Company

GPC

, each carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks Rank #1 stocks here

.

CarParts has an expected earnings growth rate of 85% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 72.7% upward over the past 30 days.

Allison has an expected earnings growth rate of 26.1% for the current year. The Zacks Consensus Estimate for ALSN’s current-year earnings has remained constant in the past 30 days.

Genuine Parts has an expected earnings growth rate of 18.1% for the current year. The Zacks Consensus Estimate for current-year earnings has remained constant in the past 30 days.

Just Released: Zacks Unveils the Top 5 EV Stocks for 2022

For several months now, electric vehicles have been disrupting the $82 billion automotive industry. And that disruption is only getting bigger thanks to sky-high gas prices. Even titans in the financial industry including George Soros, Jeff Bezos, and Ray Dalio have invested in this unstoppable wave. You don’t want to be sitting on your hands while EV stocks break out and climb to new highs. In a new free report, Zacks is revealing the top 5 EV stocks for investors. Next year, don’t look back on today wishing you had taken advantage of this opportunity.

>>Send me my free report revealing the top 5 EV stocks

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report