Shares of

RedHill Biopharma Ltd.

RDHL

were down 32.7% on Tuesday after the company announced preliminary top-line data from the phase II/III study evaluating its COVID-19 drug, opaganib, in hospitalized patients with severe COVID-19 pneumonia. The study did not meet its primary endpoint.

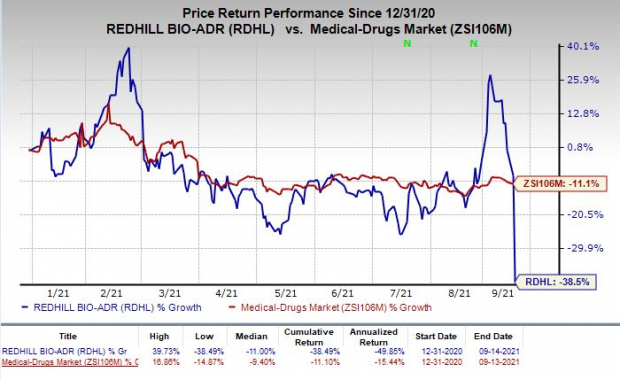

The stock has plunged 38.5% so far this year compared with the

industry

’s decrease of 11.1%.

Image Source: Zacks Investment Research

An analysis of the efficacy endpoints in the above-mentioned study showed favorable trends in the opaganib arm versus placebo across multiple endpoints, including the primary endpoint. However, the study endpoints did not achieve statistical significance. The data demonstrated a good tolerability profile of opaganib.

RedHill is analyzing the data in a subset of patients requiring less oxygen to see if opaganib has the potential to show increased benefit at earlier stages of the disease.

We remind investors that, in January 2021, the company

announced

preliminary top-line data from a phase II study in the United States on opaganib as a potential treatment for patients hospitalized with COVID-19 pneumonia. The data showed that opaganib was safe, and demonstrated greater improvement in reducing oxygen requirement by the end of treatment at day 14.

We note that opaganib, an oral pill drug candidate with dual anti-inflammatory and antiviral activity, is currently being evaluated in a phase II/III study in hospitalized patients with COVID-19.

Earlier this month, the company announced encouraging preclinical data from an in vitro study evaluating opaganib in kidney inflammation and fibrosis. Data from the same showed that opaganib achieved efficacy in significantly reducing renal fibrosis in patients with chronic kidney disease in a well-characterized unilateral ureteral obstruction model.

Apart from opaganib, RedHill is also evaluating another orally-administered drug candidate, RHB-107, in a phase II/III study, for treating non-hospitalized symptomatic COVID-19 patients. The candidate is being developed as a potential treatment in the early course of COVID-19.

Zacks Rank & Stocks to Consider

RedHill currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the biotech sector include

Spero Therapeutics, Inc.

SPRO

,

vTv Therapeutics Inc.

VTVT

and

Corvus Pharmaceuticals, Inc.

CRVS

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Spero Therapeutics’ loss per share estimates have narrowed 8.2% for 2021 and 10.6% for 2022 over the past 60 days.

vTv Therapeutics’ loss per share estimates have narrowed 23.3% for 2021 and 2.8% for 2022 over the past 60 days.

Corvus Pharmaceuticals’ loss per share estimates have narrowed 24.4% for 2021 and 21.4% for 2022 over the past 60 days.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out

Zacks’ Marijuana Moneymakers

:

An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report