Can-Fite BioPharma

CANF

announced that it is filing new patent applications in multiple countries to treat all advanced solid tumors.

The patents seek to cover Can-Fite’s growing IP portfolio, including the company’s A3 adenosine receptor ligand, namodenoson, and its use in a variety of advanced cancer indications.

This news comes a week after Can-Fite announced that one patient experienced a complete response after being treated with namodenoson in a phase II study for the treatment of advanced hepatocellular carcinoma (HCC). The complete response indicated that this patient was cleared of all tumor lesions.

Can-Fite expects to start enrolling patients in a pivotal phase III study evaluating namodenoson in advanced HCC patients with underlying Child Pugh B7 cirrhosis in first-quarter 2022. This study will also support the submission of a new drug application for namodenoson including approval.

Please note that the candidate has been granted orphan drug designation for HCC indication in both the United States and Europe. The candidate has also been granted a fast track designation by the FDA as a second-line treatment for HCC.

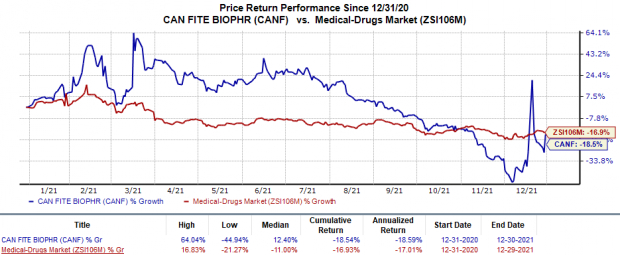

Shares of Can-Fite BioPharma have declined 18.5% so far this year against the

industry

’s 16.9% decrease.

Image Source: Zacks Investment Research

HCC is the most common form of liver cancer and one of the most frequently diagnosed cancers. Although the target market provides immense commercial potential, it is filled with marketed drugs of many established players in the pharma industry.

One of them is

Merck

MRK

, whose blockbuster drug, Keytruda, has already been granted approval by the FDA under accelerated pathway in 2018 for the treatment of HCC after being treated with sorafenib.

Earlier this Septmeber, Merck announced that the phase III KEYNOTE-394 study evaluating Keytruda in HCC patients achieved both primary and secondary endpoints. This study is also expected to serve as a confirmatory study for Keytruda in advanced HCC indication.

Keytruda is also approved for multiple cancer indications and serves as a key generator of revenues for Merck. In fact, Merck recorded $4.5 billion revenues for the third quarter of 2021.

Other than HCC, Can-Fite is also heading into a phase IIb study evaluating namodenoson for the treatment of non-alcoholic steatohepatitis. A potential development of namodenoson in these indications will provide a good impetus to Can-Fite’s prospects.

Apart from Namodenoson, Can-Fite is also evaluating its lead pipeline candidate, piclidenoson, in a phase III Comfort Study in patients with moderate to severe plaque psoriasis. The company expects to report top-line data from the Comfort Study in first-quarter 2022.

Zacks Rank & Stocks to Consider

Can-Fite BioPharma currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include

Endo Pharmaceuticals

ENDP

and

Precision BioSciences

DTIL

. While Precision BioSciences sports a Zacks Rank #1 (Strong Buy), Endo Pharmaceuticals carries a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Precision BioSciences’ loss per share estimates for 2021 have narrowed from $1.17 to $0.65 in the past 60 days. The same for 2022 has narrowed from $2.39 to $1.91 in the past 60 days.

Earnings of Precision BioSciences beat estimates in all the last four quarters, delivering a surprise of 76.9%, on average.

Endo International’s earnings per share estimates for 2021 have increased from $2.32 to $2.85 in the past 60 days. The same for 2022 has increased from $2.25 to $2.29 in the past 60 days.

Earnings of Endo International beat estimates in all the last four quarters, delivering a surprise of 57.7%, on average.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report