Baker Hughes Company

BKR

has been awarded a contract by

Tellurian Inc.

TELL

to provide electric-powered compressor technology for the latter’s $16.8-billion natural gas transmission pipeline project in Louisiana.

This will be the first time Baker Hughes will install its Integrated Compressor Line (“ICL”) decarbonization technology for pipeline compression in North America.

In 2019, Tellurian received approval from U.S. energy regulators to begin site preparation activities for the project. Tellurian will spend $240 million in the project’s first phase, which involves dual pipelines to be developed as Line 200 and Line 300.

The project will comprise four 19-megawatt ICL compressors and turbomachinery for four compressor trains. Beside this, it will consist of a gas turbine, which will be used as a backup energy source in the initial phase of the pipeline’s operation.

The project is expected to supply 5.1 billion cubic feet of natural gas per day, with no emissions. The pipelines are designed to meet demand in a capacity-constrained region of southwest Louisiana. Notably, the project is expected to provide low-carbon gas to customers in the Calcasieu and Beauregard districts of Louisiana.

Tellurian is making the initial pipeline investment as part of the broader Driftwood Pipeline system, which will provide improved security of energy supplies to meet the area’s industrial growth in a cleaner and sustainable way. Tellurian, along with Baker Hughes, will deliver cleaner solutions to meet the global energy demand.

Technology is a key driver for the renewable energy transition. Baker Hughes’ low-carbon ICL technology is already lowering the carbon footprint of pipeline projects in many regions, which deliver essential gas supplies. With the latest deal, the company is bringing it to North America, a region crucial to meeting global natural gas demand.

Company Profile & Price Performance

Headquartered in Houston, TX, Baker Hughes is one of the leading oilfield service providers.

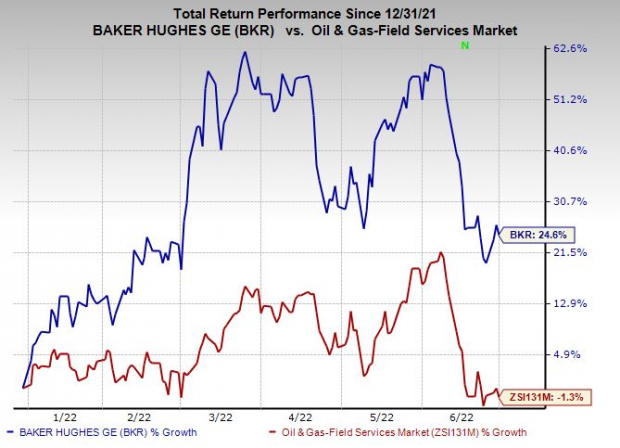

Shares of BKR have outperformed the

industry

in the past six months. The stock has gained 24.6% against the industry’s 1.3% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Baker Hughes currently carries a Zack Rank #3 (Hold).

Investors interested in the

energy

sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Range Resources Corporation

RRC

is among the top 10 natural gas producers in the United States. The upstream energy firm expects the free cash flow to exceed $1.4 billion this year, which could be the highest among Appalachian players.

Range Resources has reinstated its regular quarterly cash dividend, expected to start in the second half of this year. The company anticipated its annual dividend rate at 32 cents per share. RRC’s board of directors approved the authorization of a $500-million share repurchase program, which is likely to be funded with the company’s free cash flow generation.

Matador Resources Company

MTDR

is among the leading oil and gas explorers in unconventional resources in the United States. MTDR has hedging deals for 2022 oil and gas production in place, which will help it to navigate through any weak price environment.

Matador has a strong focus on returning capital to shareholders. MTDR recently announced a quarterly cash dividend of 10 cents per share, which doubled from the cash dividend of 5 cents initiated last year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report