Overview

Avrupa Minerals (TSXV:

AVU

) is a junior exploration and development company based in Vancouver, British Columbia. The company follows a unique prospect generator model focused on aggressive modern exploration for world-class mineral deposits in politically-stable jurisdictions across Europe, including Portugal, Kosovo and Morocco.

Avrupa’s prospect generator model is designed to create shareholder value by building an extensive portfolio of projects suitable for joint venture or sale to larger mining companies. The company routinely leverages new techniques and technologies in order to improve exploration efforts and facilitate new discoveries. In some cases, companies following the prospect generator model have become royalty companies by allowing partners to dilute them to a valuable royalty, and Avrupa has significant exposure to this route to liquidity.

The company’s projects are all located in areas with existing mines and strong geological potential for the discovery of further economic metal deposits. For example, the company’s flagship Avalade JV project is located in the pyrite belt of southern Portugal, a hotspot for resource exploration.

Company Highlights

- Operates in mining-friendly jurisdictions that are also prospective for large deposits

-

Europe offers established mining districts, pro-mining policies and a variety of metals including

gold

,

silver

,

copper

,

lead

,

zinc

and

tungsten

- Seeking partners for strategic alliances and/or project-specific JVs to fund large drill programs.

- Owns the Alvalade JV (VMS-copper-zinc), located in the Pyrite Belt of southern Portugal.

- JV earn-in agreement signed with MATSA on the Alvalade copper project

- MATSA expected to partially fund and operate the Alvalade copper project

- Slivovo JV (gold, silver) with Byrnecut International in the Vardar Mineral Belt in Kosovo. Discovery made in 2015. Initial Gold Resource Estimate completed in April, 2016.

- Made two significant discoveries: the Slivovo gold target and the Sesmarias VMS at Alvalade.

- Extensive work conducted on Alvito IOCG project in Portugal

Key Projects

Alvalade copper project

The Iberian Pyrite Belt (IPB) is one of the world’s largest and most prolific copper-zinc-iron massive sulfide belts with mining history dating back more than 2,000 years. Three out of four of the last greenfield discoveries in the IPB are now large operating mines including the giant Neves Corvo copper-zinc-tin massive sulfide mine. However, the area has not experienced any real exploration since the mid-1990s, when Avrupa Minerals’ team began applying their expertise to the region resulting in a new discovery at Alvalade.

Avrupa Minerals’ IPB licenses (including the Alvalade and Alvito JVs) are located along trend to the northwest of Neves Corvo, which is currently the largest operating copper-zinc mine in Europe.

The Alvalade project involves an earn-in agreement that Avrupa (the operator) does not have to fund at present. The project was previously optioned to Antofagasta Minerals, one of the world’s largest copper producers. Armed with a new geological model, Avrupa Minerals was able to successfully complete four rounds of drilling at Alvalade between April 2012 and October 2014.

The initial 2014 drill program made a significant VMS discovery in the Sesmaria West target on the Alvalade JV; the first of its kind on the Iberian Pyrite Belt in 20 years. New massive sulfide targets were also identified at Sesmarias East and at Pombal 15km south of the Sesmarias area.

Sesmarias drill results include:

- SES002 – 10.85 meters @ 1.81 percent copper, 75.27 ppm silver, 2.57 percent lead, 4.38 percent zinc, 0.13 percent tin

- SES010 – 57.85 meters @ 0.45 g/t gold, 25.1 g/t silver, 0.32 percent copper, 0.61 percent lead, 1.95 percent tin

The key highlights of the 2014 Drill Program results include:

- The potential for a largescale Sesmarias system, with previously-documented sulfide mineralization around the peripheries of the present target area

- The comparison of the size of a potential Sesmarias system to the size of the giant Neves-Corvo deposits, located 50 kilometers southeast of Sesmarias and presently mined by Lundin Mining Company

- Historic drilling missed the actual target rock package, leaving a 2,500-meter strike length of undrilled target area at Sesmarias

- The complicated geology and structure of the Sesmarias area increase the difficulty in locating lenses of massive sulfide mineralization

Under a new partner, a drill program was initiated in Q4 2015. Four holes were drilled around the area of SES010 and results confirmed and extended the massive sulfide lens to a present length of 300 meters with a 35-40 meter thickness.

Sesmarias “2” Lens

In March 2019, Avrupa Minerals

released assay results

for drill hole SES003, which was drilled on the Avalade project back in 2014. The results from SES003 were not initially analyzed due to its general proximity to SES002.

Sesmarias 2 Lens results include:

- SES003 – 13.65 meters @ 1.92 percent copper, 38.8 ppm silver, 1.03 percent lead, 1.91 percent zinc, 0.03 percent tin

In October 2019 Avrupa Minerals entered into a

letter of intent

with Minas de Aguas Teñidas, S.A.U. (MATSA) to form an earn-in exploration and exploitation joint venture on the Alvalade copper-zinc massive sulfide project. Under the terms of the agreement, the companies have created a new joint venture company to direct future operations.

The first stage of the JV is designed to delineate a deposit at Sesmarias and the other mineralized targets within the boundaries of the Alvalade license including the past-producing Lousal Mine, Monte de Bela Vista and the past-producing Caveira Mine. Avrupa has also defined a number of additional drill-ready targets across the property.

Sesmarias “10” Lens

In February 2019, Avrupa Minerals

reported additional drill results

from the Sesmarias prospect, located on the Alvalade license in the Pyrite Belt of south Portugal. The company completed six holes totaling 2,498 meters including results from SES026, which extended the “10” lens by 300 meters to the north.

Sesmarias 10 Lens results include:

- SES026 – 28.95 meters @ 0.48 percent copper, 0.77 g/t gold, 15.7 ppm silver, 0.52 percent lead and 1.31 percent zinc.

In order to acquire a 51 percent interest in the new JV company, MATSA must make a

series of payments

, including 1.2 million euros during the first year of the agreement and another 1.2 million euros at MATSA’s discretion over the following two years. MATSA also has the opportunity to earn-in to 85 percent of the project by providing a bankable feasibility study while also making all required payments to the original JV partner.

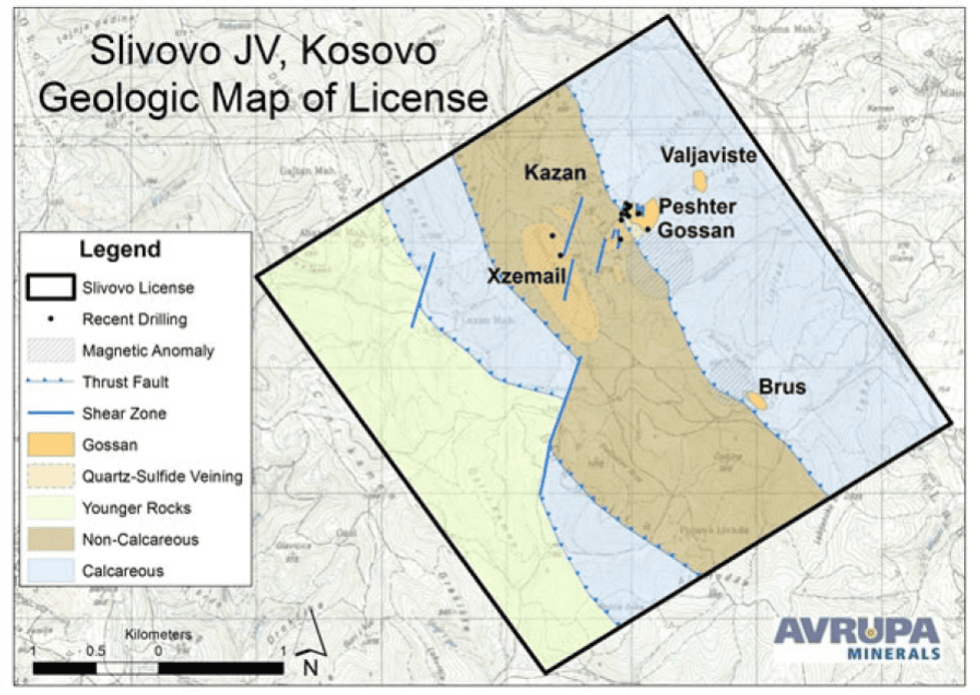

Avrupa Minerals’ Slivovo JV Project

The Slivovo JV project in Kosovo’s Vardar Mineral Trend is operated and funded by partner Byrnecut International Ltd. Byrnecut has completed an 85 percent earn-in requirement by spending over 3 million euros for exploration on the 15.2 km2 Slivovo license, outlining a maiden gold resource estimate of 98,700 ounces of gold indicated in 640,000 metric tonnes grading 4.8 grams per ton gold. Byrnecut is a mining contractor and has completed a study to earn up to 85 percent of the project.

In 2011, widescale geological mapping of the Peshter gossan zone on the Slivovo property led to the discovery of the potential for the gold-bearing, massive sulfide mineralization common in the Vardar Mineral Trend.

Discovery outcrop at Main Gossan

Under the JV signed in 2014, Avrupa Minerals stepped up the exploration activity at Slivovo with an aggressive exploration program that has included trenching, first-pass and follow-up geological mapping, sampling and drill targeting. Phase one drilling totaled 1,002 meters and was completed in Q4 2014 (see

December 17, 2014

and

January 27, 2015

news releases). Highlights of this first drill campaign include:

- 126.5 meters @ 6.2 g/t gold, 15.0 g/t silver, 0.092 percent copper, 0.16 percent lead, and 0.45 percent zinc in SLV004

- 12 meters @ 12.2 g/t gold, including 7.4 meters @ 19.3 g/t gold in SLV005

- 8 meters @ 1.25 g/t gold and 3.4 meters @ 3.12 g/t gold in SLV006

Phase two drilling totaled 1,025 meters and was completed in Q2 2015 (see

May 28, 2015

news release) and included 30 meters @ 6.92 g/t gold and 16.20 g/t silver in SLV011.

Drilling at SLV001 Slivovo JV

Phase three drilling was completed which totaled 46 holes and 5,040 meters. Results released by Avrupa Minerals include:

-

57.35 meters @ 2.09 g/t gold and 15.94 g/t arsenic in SLV014 (see

June 25, 2015

news release). -

125 meters of 6.91 g/t gold and 19.19 g/t silver in SLV018( see

August 17, 2015

news release) -

SLV025 intercepts 24 meters of 11.59 g/t gold, 9.26 g/t silver (see

September 21, 2015

news release) -

42 meters @ 9.20 g/t gold and 9.57 g/t silver in SLV033 (see

October 26, 2015

news release) -

74 meters @ 6.02 g/t gold and 20.23 g/t silver in SLV037 (see

November 25, 2015

news release)

“The final results from the Phase 3 drilling clearly enhance the mineral inventory at Peshter gossan zone on the Slivovo property. The Project has been a real success. We have completed our goals in a timely manner, within budget, and with an industry best-practices standard. We are excited to be able to produce an initial resource estimate at Slivovo within 19 months of start-up for just two million euros. In addition, looking ahead, we are also excited about the nearby targets with gold potential as we unlock the geological story and use this knowledge to direct further exploration to increase the size of the gold deposit,” said Paul W. Kuhn, president and CEO of Avrupa Minerals.

Byrnecut completed a large program in 2017 to follow up on a section of mineralization that hit a new extension of gold in three deeper holes that had similar grades to the average of the resource estimate at 4.8 g/t gold. This data is not currently in the resource estimate. Avrupa has chosen not to fund its share of the program and could be diluted to a 2 percent NSR without any further funding from the company.

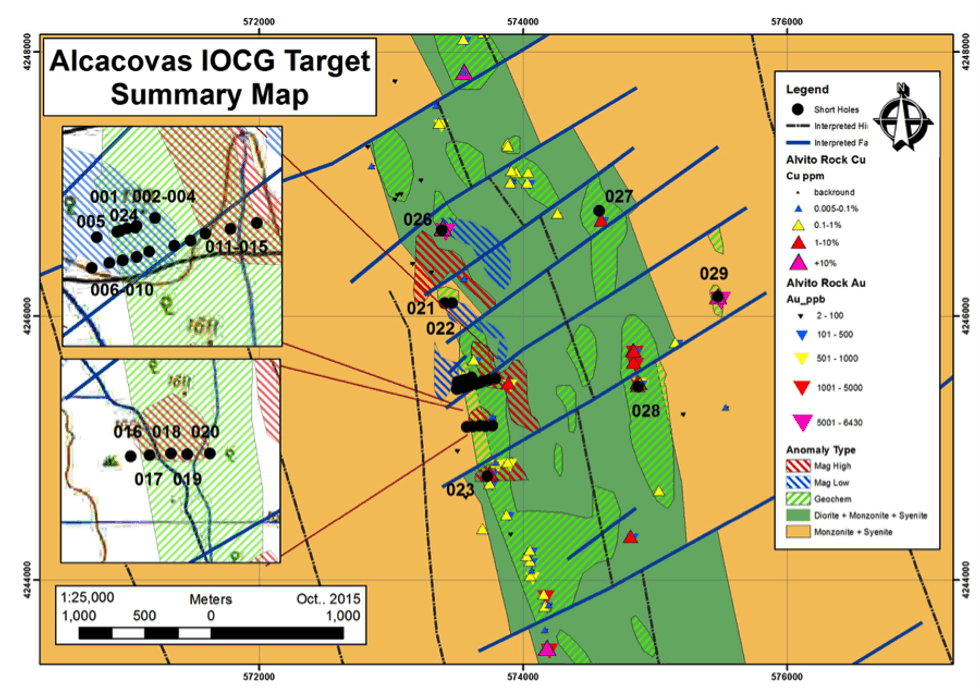

Avrupa Minerals’ Alvito IOCG Project

The Alvito iron oxide-copper-gold project covers 853 km2 straddling the northeastern margin of the IPB.

Highly successful fieldwork at Alvito has already identified the potential for significant copper-gold mineralization and led to the discovery of a large epithermal silver-lead-zinc veining system.

Avrupa has completed further geological mapping, in-fill soil sampling, and sub-surface rock sampling, utilizing a portable drill rig to access down to a maximum of approximately 20 meters depth. 29 short holes were drilled, totaling 356 meters, at eight targets located along two sub-parallel trends of strong copper-in-soil anomalism.

Location of the short hole drilling at the Alcaçovas IOCG prospect.

Avrupa Minerals also has three other licenses in the IPB including Marateca, Santa Margarida do Sado and Mertola.

In April 2017, Avrupa entered into an option agreement for the Alvito project with OZ Minerals, based out of Australia. As part of the agreement, OX may earn-in up to 51 percent by spending AUS$1 million on project initiatives. Meanwhile, Avrupa maintained its status as the primary project operator and led a series of exploration initiatives over the summer of 2017.

Exploration work conducted in that period included ground geophysical surveys, data collection, rock sampling and geological mapping. Sample results uncovered copper and gold mineralization with results of up to 13.1 ppm gold and 5,820 ppm copper, and 4.52 ppm gold and 7,900 ppm copper. These activities led to the uncovering of new copper targets and the company established drill targets for a 1,500-meter to 2,000-meter drilling program to be launched in April 2018.

In the summer of 2018, Avrupa conducted a first-pass exploration

drill program

on the Alvito project. Highlights included 83 meters at 0.16 percent copper, including 9.8 meters at 0.41 percent copper in EMS001. The exploration program was fully funded by OZ Minerals, which had the opportunity to spend AUS$1 million to earn a 51 percent earn-in on the project. The company later declined its earn-in rights, giving

100 percent ownership

of the project back to Avrupa Minerals.

Management Team

Paul Kuhn—CEO & Director

Mr. Kuhn joined Avrupa Minerals in July 2010 after working with Metallica Mining in Oslo, Norway since August 2008. He has more than 30 years of experience in the minerals exploration business in North America, Central Asia and Europe. He earned an A.B. Degree from Dartmouth College, US, in 1978, and an M.S. Degree from the University of Montana, US, in 1983. Mr. Kuhn has worked in a variety of geological terrains, exploring for gold, silver, base metals, uranium, and phosphate deposits, and has spent time as a production geologist in the deep underground mines of the Coeur d`Alene Mining District, historically one of the world’s most important silver districts. Mr. Kuhn has managed successful exploration programs in the US and Turkey, and was involved in a number of base and precious metal discoveries in Turkey, including the Taç and Çorak polymetallic deposits (presently being developed by Mediterranean Resources), the Cerattepe Cu-Au volcanogenic massive sulfide deposit (held by Inmet Mining), the Altıntepe epithermal Au deposit (being developed by Stratex International), the Diyadın Carlin-style Au deposit (developed by Newmont Mining and currently held by Koza Altin), and the Karakartal porphyry Cu-Au deposit (being developed by Anatolia Minerals). Mr. Kuhn was also involved with the original mapping and description of the Çöpler porphyry Au deposit (presently under mine construction and development by Anatolia Minerals).

Mark T. Brown—Director

Mr. Brown is the President of Pacific Opportunity Capital Ltd., headquartered in Vancouver B.C. Pacific Opportunity is a financial consulting and merchant banking firm active in venture capital markets in North America. Mr. Brown has assisted in the successful establishment of several private and public companies. In the mining and mineral exploration sector, Mr. Brown has played key roles in the success of Rare Element Resources Ltd., Sutter Gold Mining Ltd., Portal Resources Ltd., Pitchstone Exploration Ltd., Animas Resources, and other junior exploration companies. His corporate activities include merger and acquisition transactions, financing, strategic corporate planning, and corporate development. Prior to joining Pacific Opportunity, Mr. Brown managed the financial departments of two TSE 300 companies, Miramar Mining Corp. and Eldorado Gold Ltd. Mr. Brown has a Bachelor of Commerce from the University of British Columbia and qualified as a Chartered Professional Accountant in 1993, while working with PricewaterhouseCoopers in Vancouver.

Paul Dircksen— Director

Mr. Dircksen has more than 35 years of experience in the mining and exploration industry, serving in executive, managerial, and technical roles at several companies. He has a strong technical background, serving as a team member on ten gold discoveries, seven of which later became operating mines. Mr. Dircksen has held senior management positions with a number of resource groups including Orvana Minerals, Lacana Gold, The Cordex Group, Brett Resources, and the Bravo Venture Group. He holds an M.S. in Geology from the Mackay School of Mines at the University of Nevada.

Mr. Dircksen is currently the President and CEO of Timberline Resources Corporation which is listed on the NYSE Market Exchange under the symbol “TLR” and on the TSX Venture Exchange under the symbol “TBR”. Timberline holds a 50-percent carried interest ownership stake in the Butte Highlands Joint Venture in Montana, USA. Timberline Resources focuses on exploration and development of precious metal deposits in the western United States.

Frank Högel – Director

Mr. Högel currently serves as the CEO of Peter Beck Performance Funds GbR and sits on the advisory board of Concept Capital Management. Concept Capital is an asset management company focused on evaluating and investing in Canadian resource companies through equity investments, convertible bonds and gold, silver and copper off-take agreements. Mr. Högel has a MBA with a focus on financial management, banking, and international business and management from the University of Nürtingen, Germany. He also sits on the board of several other public companies listed on the TSX Venture Exchange.

Paul Nelles—Director

Dr. Nelles graduated from TU Berlin in 1972 with a degree in mining engineering and obtained a PhD in mineral processing in 1975. He worked internationally in base metal mining for Metallgesellschaft between 1975 and 1991, at which stage he held the position of General Manager Project Development. In 1991 he was employed as technical director and appointed to the executive board of DESTAG, a leading dimension stone producer and worldwide trader. He was subsequently appointed CEO of the company. Dr. Nelles joined Normandy LaSource in France, as executive director for gold production and industrial minerals in 1997. In 2002 he was appointed as the “Trepca Manager” by the United Nations Mission in Kosovo and was promoted to Deputy Managing Director of the Kosovo Trust Agency in 2004, in charge of all major publicly owned enterprises. Since 2006 he has worked as an independent mining industry advisor and has been instrumental in the formation of Innomatik Exploration Kosovo LLC, a wholly-owned subsidiary of Avrupa Minerals.

Winnie Wong – CFO

Ms. Wong received a Bachelor of Commerce Degree (Honours) from Queen’s University in 1996 and is a Chartered Professional Accountant. She is currently Vice President of Pacific Opportunity Capital Ltd. Prior to joining Pacific Opportunity Capital Ltd., Ms. Wong was the controller of Pivotal Corporation, a company providing software, services, and support to a variety of businesses. Between 1996 and 1999, Ms. Wong worked with Deloitte & Touche, Chartered Accountants.

For further details see: