Aerie Pharmaceuticals

AERI

announced that it has started dosing patients in the phase III COMET-2 study with AR-15512, its investigational ophthalmic solution, for the treatment of signs and symptoms of dry eye disease (DED).

While the primary efficacy assessment of the COMET-2 study is tear production, which will be measured by the unanesthetized Schirmer test (sign), the key secondary measure is dry eye symptoms, based on the Symptom Assessment iN Dry Eye (SANDE) questionnaire. The study will also evaluate participants based on other assessments at multiple timepoints throughout the study tenure.

Top-line data from the study is expected in the second half of 2023.

The COMET-2 study will evaluate the safety and efficacy of AR-15512, a TRMP8 agonist, in patients with DED. The study will randomize participants to either receive AR-15512 (0.003%) or AR-15512 vehicle, dosed twice daily in each eye, for three months.

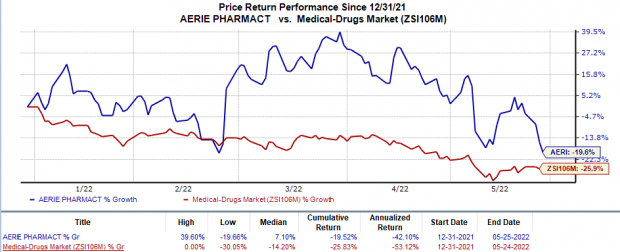

Shares of Aerie have declined 19.5% in the year so far compared with the

industry

’s 25.8% decrease.

Image Source: Zacks Investment Research

The initiation of the COMET-2 study is based on data from the phase IIb COMET-1 study, which evaluated AR-15512 in DED patients. While the study

did achieve

a statistical significance over multiple pre-specified symptoms and sign endpoints, it did not achieve all pre-determined primary endpoints with statistical significance.

The COMET-2 study is one of the three studies in the phase III registrational program, seeking approval for AR-15512 to address DED. Aerie plans to start the COMET-3 study, which is identical to the COMET-2 study, in third-quarter 2022. Management also aims to begin the phase III COMET-4 study, which is also a 12-month safety study, in fourth-quarter 2022.

AERI expects data from these three studies to support a potential new drug application (NDA), seeking approval for AR-15512 to treat DED. Aerie expects to file the NDA in 2024.

Zacks Rank & Stocks to Consider

Aerie currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector are

Abeona Therapeutics

ABEO

,

Alkermes

ALKS

and

Angion Biomedica

ANGN

, each of which has a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Abeona Therapeutics’ loss per share estimates for 2022 have narrowed from 33 cents to 31 cents in the past 30 days. The same for 2023 has narrowed from 15 cents to 13 cents in the past 30 days. Shares of ABEO have declined 54.7% in the year-to-date period.

Earnings of Abeona Therapeutics missed estimates in two of the trailing four quarters and met the same on the remaining two occasions, the average negative surprise being 8.2%. In the last reported quarter, Abeona Therapeutics missed on earnings by 25%.

Alkermes’ loss per share estimates for 2022 have narrowed from 10 cents to 3 cents in the past 30 days. Shares of ALKS have risen 21.9% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Angion Biomedica’s loss per share estimates for 2023 have narrowed from $2.19 to $2.07 in the past 30 days. Shares of ANGN have plunged 57.6% in the year-to-date period.

Earnings of Angion Biomedica beat estimates in three of the last four quarters and missed the mark once, the average surprise being 58.1%. In the last reported quarter, Angion Biomedica missed on earnings by 9.1%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report