Aerie Pharmaceuticals

AERI

is focused on the development and commercialization of eye-disease therapies, including glaucoma and other eye-diseases.

Currently, this Irvine, CA-based playerhas two marketed drugs in its portfolio, namely Rhopressa and Rocklatan, both approved by the FDA for the reduction of elevated intraocular pressure (IOP) in adult patients with primary open-angle glaucoma or ocular hypertension.

Glaucoma is one of the largest segments in the global ophthalmic market. According to the National Eye Institute more than 2.7 million individuals in the United States are estimated to suffer from glaucoma. This number is expected to reach 4.3 million by 2030. Further, the Eye Diseases Prevalence Research Group estimated that only half of the U.S. glaucoma-afflicted patients know that they have the disease.

We note that the sales of Aerie’s both ophthalmology drugs are slowly and steadily gaining traction. Product sales are rising consistently year over year. To expand the geographical presence of its drugs beyond the United States, AERI partnered with Santen Pharmaceuticals Co., Ltd. to advance its clinical development and ultimately commercialize Rhopressa and Rocklatan in the ex-U.S. markets, including East Asia, Japan, Europe, China and India. Marketing approvals in these regions will result in Aerie earning royalties on the sales of these drugs as well as milestone payments.

Other than the United States, Rhopressa and Rocklatan received an approval for a similar indication in Europe, currently being marketed under the trade names Rhokiinsa and Roclanda, respectively.

To demonstrate the efficacy of Rocklatan as the first-line therapy or first go-to switch brand, Aerie intends to start a phase IV study on the drug in second-quarter 2022.

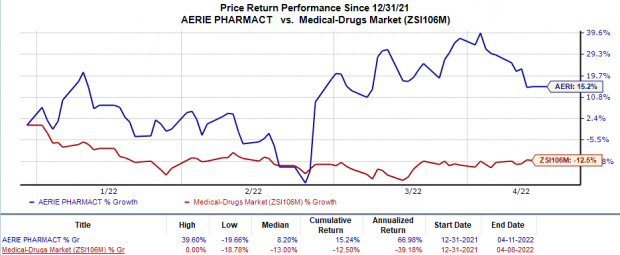

Shares of Aerie have risen 15.2% so far this year against the

industry

’s 12.5% decline.

Image Source: Zacks Investment Research

Apart from Rocklatan and Roclanda, Aerie is developing candidates for other retinal indications in its pipeline. While AERI is developing AR-15512 for treating patients with dry-eye disease, AR-1105 is being developed for patients with macular edema due to retinal vein occlusion (RVO). Both candidates are on track to enter the late-stage studies toward this year-end.

Aerie is also evaluating AR-13503 SR for the treatment of wet AMD and DME in a first-in-human clinical study, currently ongoing for the potential treatment of wet age-related macular degeneration (wet AMD) and diabetic macular edema (DME). AERI also plans to file an investigational new drug (IND) application in second-half 2022 for AR-14034 SR, a sustained-release retinal implant containing the pan-VEGF receptor inhibitor axitinib.

Although the target market holds potential, Aerie’s drugs face stiff competition from

Bausch

Health

’s

BHC

Vyzulta, which is approved for reducing IOP in patients suffering open-angle glaucoma or ocular hypertension. The FDA approved BHC’s Vyzulta in 2017. The drug was licensed by Bausch Health in 2010 from France-based ophthalmology company Nicox S.A.

Zacks Rank & Key Picks

Aerie currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same sector are

Assertio

ASRT

and

Collegium Pharmaceutical

COLL

, each currently sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Assertio’s earnings per share estimates for 2022 have increased from 20 cents to 35 cents in the past 60 days. Shares of ASRT have rallied 56.9% in the year-to-date period.

Earnings of Assertio beat estimates in two of the last four quarters and missed the mark in the other two, the average surprise being 20.8%.

Collegium Pharmaceutical’s earnings per share estimates for 2022 have increased from $3.79 to $5.59 in the past 60 days. The same for 2023 has increased from $4.79 to $7.44 in the past 60 days. Shares of COLL have risen 9.8% year to date.

Earnings of Collegium Pharmaceutical missed estimates in three of the last four quarters and beat the mark on one occasion, the negative surprise being 57.6%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report